Parliament has approved tax waivers of over Shs9.5 billion for selected local investors for the financial year 2024/2025.

This followed the adoption of the report of the Committee on Finance, Planning, and Economic Development on approval of the waivers.

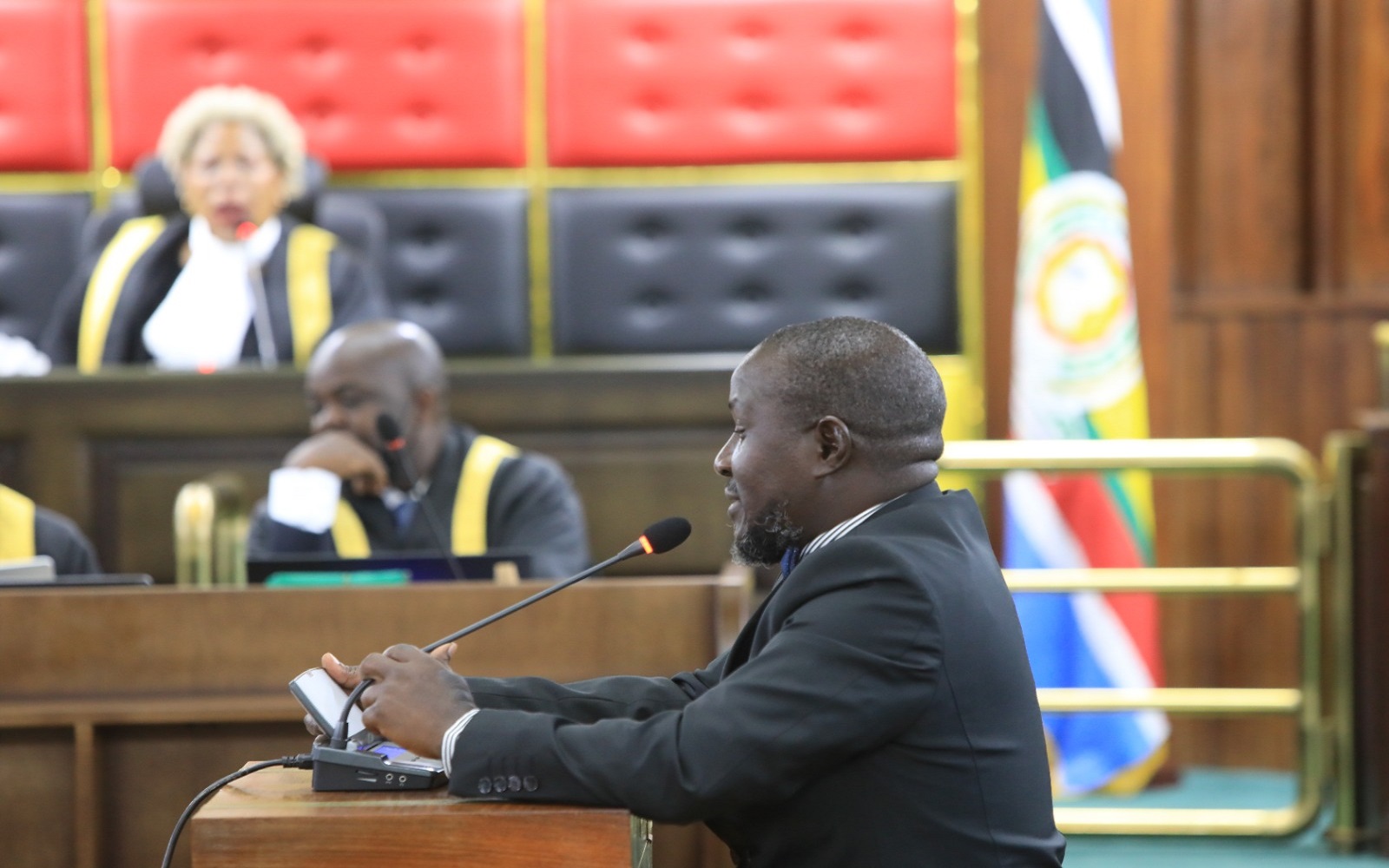

The report presented by Committee Chairperson, Hon. Amos Kankunda on Thursday, 20 February 2025 highlighted the tax liabilities of various universities and private businesses that had applied for waivers.

The exemptions, granted under Section 40(1) of the Tax Procedures Code Act, 2014 were based on financial hardships and the strategic importance of the entities to economic development.

The Minister of State for Finance (General Duties), Hon. Henry Musasizi who moved the motion stated that all the organisations granted the waivers qualified and were ably vetted.

Kankunda warned that Uganda continues to forgo significant revenue through tax exemptions citing a loss of Shs2.9 trillion in tax expenditures in the last financial year alone which represented 12.5 per cent of the total revenue collected.

The approved tax waivers include Shs2.7 billion for J2E Investment Corporation Ltd, a construction company in unpaid Value Added Tax (VAT) arising from government delays in settling payments for construction projects, Shs931 million for M/S Nicontra Ltd, a road construction firm whose tax arrears were affected by Uganda Revenue Authority (URA)’s payment allocation rules.

Nkumba University’s waiver of Shs4.4 billion was occasioned by declining student enrolment and a drop in tuition revenue, Shs783 million for Busoga University following a government decision to take over the institution, Shs239 million for Makerere Business Institute, which struggled with tax compliance due to the COVID-19 pandemic and Shs77 million for Kisiizi Hospital Power Ltd to support its role in supplying affordable electricity to rural communities.

However, during debate, Hon. Asuman Basalirwa (JEEMA, Bugiri Municipality, Bugiri) questioned how investors that benefited from the exemption were selected.

“How does a peasant from deep in Kabale get to know about these opportunities? Did the Committee chairperson interrogate these issues of information and transparency?” he questioned.

Speaker Anita Among however, guided that it is Members of Parliament who must tell their people about the benefits and opportunities that they are entitled too.

Kampala Central Member of Parliament, Hon. Muhammad Nsereko proposed that there is need to consider small and medium business personnel including removing penalties which are hurting the economy.

Kankunda revealed that whoever is struggling and wishes to have a waiver, can apply through Uganda Revenue Authority.